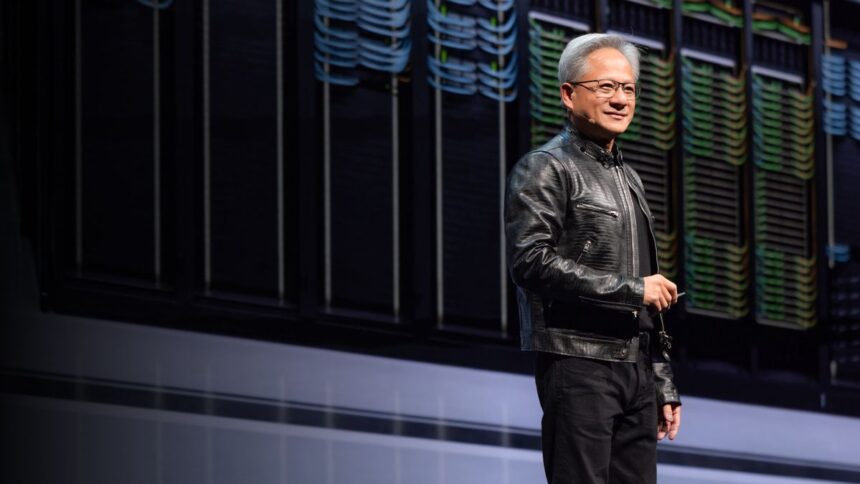

At GTC 2025, the world’s largest artificial intelligence event held this week in San Jose, California, Nvidia CEO Jensen Huang declared that the company is no longer just a graphics chip manufacturer but an AI infrastructure company.

This announcement comes at a time when AI is no longer just a futuristic concept but the driving force behind global digital transformation. With a market valuation surpassing $2.9 trillion, Nvidia has solidified its position as the leading provider of AI infrastructure, even surpassing tech giants like Apple, Microsoft, and Google in market value.

Beyond this strategic shift, Nvidia has also revealed plans to invest “hundreds of billions of dollars” in U.S. manufacturing over the next four years, reinforcing its commitment to advancing AI and semiconductor production.

From graphic chips to AI factories

Although Nvidia began as a company focused on 3D graphics cards for gamers, it has undergone a profound transformation. “We are an AI infrastructure company. We are an infrastructure company, not just ‘buy chips, sell chips,'” Nvidia CEO Jensen Huang told reporters during GTC 2025 in San Jose.

This shift didn’t happen overnight. Founded in 1993, Nvidia first built its reputation by developing GPUs for gaming, but over time, it expanded into high-performance computing and, eventually, artificial intelligence. The turning point came when researchers discovered that Nvidia’s GPUs were exceptionally well-suited for training deep learning models, laying the groundwork for today’s AI boom.

Now, Nvidia sees itself as more than just a chip supplier—it’s building the foundation for AI development. During his GTC 2025 keynote, Huang unveiled four new GPU architectures that will shape the company’s strategy through 2027:

- Blackwell Ultra (2025)

- Vera Rubin (2026)

- Feynman (2027)

- A yet-to-be-named fourth architecture

This roadmap reflects Nvidia’s new vision: not just selling chips but designing and building the infrastructure that will define the future of technology.

Implications and challenges of the new era

Nvidia’s shift into an “AI factory” has significantly raised expectations. “The business standard is now much, much, much higher than before,” CEO Jensen Huang admitted during GTC 2025. “The competition bar is higher, and risk tolerance is lower for all our customers. Their revenue depends on this technology. It’s a multi-year investment cycle involving hundreds of billions of dollars.”

As a central player in the AI ecosystem, Nvidia now faces unprecedented scrutiny. In the past, a bug in a GPU might have frustrated gamers, but today, a failure in its hardware could disrupt critical services and multi-billion-dollar operations. This means Nvidia must not only innovate constantly but also ensure each new generation of products is highly reliable from day one. Huang acknowledged this challenge, revealing that cloud customers now plan their infrastructure purchases at least two years in advance to align with Nvidia’s roadmap.

Balancing Supply and Demand

Another major challenge is meeting skyrocketing demand. Despite ramping up production, supply still falls short. Huang announced that in 2024, Nvidia sold 3.6 million Blackwell GPUs to the top four U.S. cloud providers, a major increase from the 1.3 million Hopper GPUs sold the previous year. However, even this surge doesn’t cover the full market demand. Huang pointed out that these figures don’t include orders from Meta, smaller cloud providers, or AI startups, suggesting that the real demand is even higher.

As Nvidia cements its role as the backbone of AI infrastructure, it must navigate the challenges of scaling production, maintaining reliability, and staying ahead in an increasingly competitive landscape.

Nvidia’s AI Transformation Backed by Record-Breaking Growth

Nvidia’s strategic shift toward AI is backed by staggering financial growth. Since early 2023, the company’s stock value has more than doubled, fueled by the AI boom. In its latest fiscal quarter, Nvidia reported a 12% revenue increase, surpassing all analyst expectations and setting new records.

The AI infrastructure market presents a massive opportunity. During GTC 2025, CEO Jensen Huang projected that Nvidia’s data center infrastructure revenue could hit $1 trillion by 2027. This bold forecast seems realistic, given his claim that the computational demand for agentic AI—systems capable of reasoning and contextual decision-making—is “easily 100 times larger than we thought we needed last year.”

A New Business Model: From Supplier to Essential Partner

What makes Nvidia’s strategy even more compelling is its new business model. “Our factories translate directly into customers’ revenue,” Huang explained, emphasizing Nvidia’s role as an indispensable partner for AI-driven businesses. This shift—from merely supplying components to directly enabling revenue generation—greatly enhances Nvidia’s market value and cements its dominance in the AI industry.

Nvidia Adapts to U.S. Tariffs on China with Supply Chain Flexibility

With the Trump administration imposing 20% tariffs on Chinese products, Nvidia faces the challenge of maintaining an efficient and competitive supply chain. However, CEO Jensen Huang remains confident in the company’s ability to navigate these hurdles.

“We have a network of really agile suppliers. They are not just in Taiwan, Mexico, or Vietnam. They are distributed in many places,” Huang stated during GTC 2025. He emphasized that while tariffs may affect certain regions, Nvidia’s global supplier base provides flexibility. “Based on what we know, we don’t expect a significant impact on our outlook or financials in the short term.”

A Strategic Shift to U.S. Manufacturing

While supply chain diversification helps Nvidia mitigate trade risks, the company is also taking a bolder step—moving a significant portion of its manufacturing to the United States. This decision circumvents tariffs and aligns Nvidia with Trump’s ‘America First’ policy, potentially securing greater government support for its operations.

As global trade tensions evolve, Nvidia’s ability to adapt and localize production could further strengthen its dominance in the AI and semiconductor industries.

Nvidia Plans Major U.S. Manufacturing Expansion Amid Geopolitical Shifts

In an interview with the Financial Times, Nvidia CEO Jensen Huang outlined the company’s ambitious plan to expand manufacturing in the United States. “Over the next four years, we will likely acquire around half a trillion dollars in electronics. I think we can easily see several hundred billion of that being produced here in the U.S.,” he stated.

TSMC’s $100 Billion Investment: A Game Changer

This move is largely enabled by TSMC’s $100 billion investment in new manufacturing plants in Arizona. “TSMC’s investment in the U.S. significantly strengthens the resilience of our supply chain,” Huang explained, underscoring the critical role of this partnership in Nvidia’s long-term strategy.

Reducing Dependency on Taiwan and Securing U.S. Support

Nvidia’s investment isn’t just about bypassing tariffs—it’s also a response to the growing tensions between China and Taiwan, the world’s primary hub for advanced chip manufacturing. By building a strong production base in the U.S., Nvidia aims to reduce reliance on geopolitically sensitive regions and position itself for greater government support.

“Having an administration that prioritizes this industry’s success and ensures energy isn’t an obstacle is a phenomenal boost for AI in the U.S.,” Huang added, emphasizing how this shift aligns with U.S. industrial policies aimed at reclaiming leadership in semiconductor manufacturing.