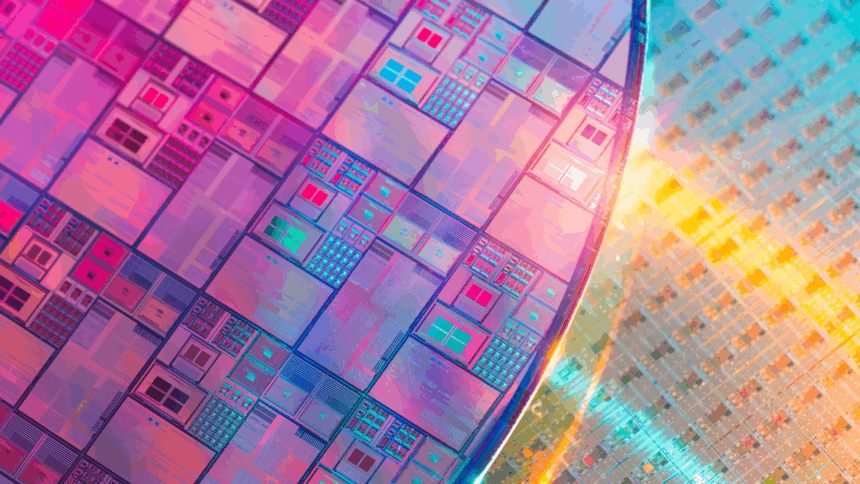

Samsung is reportedly already laying the groundwork for its 1 nm lithography process, despite not having begun mass production of its 2 nm process yet. According to sources from South Korean outlet Sedaily, the development of 1 nm technology is still in its early stages, with production expected to begin around 2029, making it a long-term project aimed at the next decade.

It’s believed that Samsung has reallocated part of its team working on 2 nm technology to kickstart the initial research and development for 1 nm lithography. Once fully realized, this technology could potentially revolutionize the semiconductor industry by drastically improving chip performance and efficiency.

However, the success of 1 nm chips will depend heavily on the use of advanced EUV (Extreme Ultraviolet) lithography tools and techniques, which are not yet in widespread use. By pushing ahead with these advancements, Samsung aims to challenge its key competitor TSMC, who is also working on sub-2 nm processes.

2 Nm from Samsung should be used by AMD and NVIDIA

Internally, Samsung is referring to its next-generation 1 nm lithography process as the “dream process” due to its potential impact on the semiconductor industry, particularly in memory technologies. As a world leader in memory production, Samsung expects this advancement to significantly improve performance and efficiency across a variety of chip applications.

Meanwhile, Samsung’s 2 nm process is reportedly only achieving a 40% silicon usage rate so far. For context, TSMC, a major competitor, has already reached about 80% utilization with its own 2 nm technology. This means that Samsung still has considerable work ahead to catch up with TSMC’s progress, especially if they hope to compete at the same level by the second half of the decade.

In terms of interest from major tech companies, AMD, Apple, and Nvidia are all reportedly showing interest in Samsung’s 2 nm technology. However, there is a possibility that these companies may also seek to outsource their production to TSMC, potentially leveraging both manufacturers’ offerings to optimize their semiconductor needs.