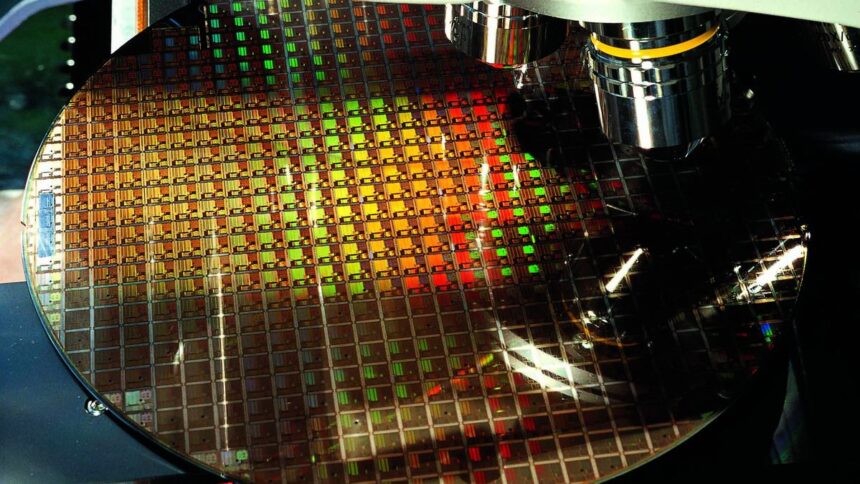

Taiwan remains at the forefront of the semiconductor industry, largely thanks to TSMC. A recent report from a local news outlet further emphasizes the company’s dominance, highlighting that by next year, TSMC will be operating at full capacity with its 3 nm and 5 nm silicon wafers.

Sources from the report attribute the soaring demand for these semiconductors to the rising need for AI chips. NVIDIA, for instance, is using 5 nm wafers for its upcoming Blackwell B200 GPUs, which are expected to play a major role in the company’s strategy for dominating the AI market.

While the release date for these new NVIDIA chips hasn’t been confirmed, they are anticipated to launch later this year, with an initial batch of 200,000 units. As a result, TSMC has reportedly prioritized the production of these chips, even going so far as to exceed its normal manufacturing capacity, pushing beyond 100% utilization.

Demand is expected to remain high in 2025

In addition to the Blackwell B200 GPUs, NVIDIA has another major demand on the horizon with its B300A series, which will be based on Blackwell Ultra and is expected to arrive in the second half of 2025.

To meet the growing demand, TSMC plans to ramp up its production of 5 nm silicon wafers at its new factory in Arizona, set to begin operations in early 2025.

The 3 nm manufacturing process is already widely used by industry leaders such as Apple, MediaTek, and Qualcomm, further solidifying TSMC’s position in advanced semiconductor production.

While Samsung and Intel are working to expand their capabilities, they are still limited by the constraints of their facilities, with a stronger focus on in-house production despite having some external clients.

TSMC, on the other hand, continues to lead the market, boasting a client roster that includes major technology players such as AMD, Apple, NVIDIA, Qualcomm, MediaTek, Broadcom, and even Intel. Interestingly, despite its manufacturing capabilities, Intel has reportedly turned to TSMC to boost production for its current processors, according to industry rumors.