Intel is currently facing one of its biggest crises. The situation has become so severe that the U.S. government is considering potential acquisitions or mergers, even with direct competitor AMD.

As reported by Semafor, U.S. lawmakers are particularly concerned about Intel’s challenges. This concern was heightened after the company reported a net revenue loss of $16 billion in the last quarter, reflecting the ongoing financial struggles.

The U.S. Department of Commerce officials have debated whether the “CHIPS Act” — a multibillion-dollar initiative to boost American semiconductor production — would stabilize Intel’s current predicament.

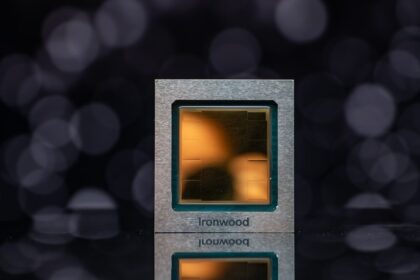

The situation is so critical that senior officials are discussing whether a merger with AMD or Marvell, another American semiconductor manufacturer, could be a potential solution.

Intel comments on the matter

Intel is going through one of its most challenging crises yet. The situation has escalated to the point where the U.S. government is exploring options for potential acquisitions or mergers, including with its direct competitor, AMD.

“Intel is the only U.S. company that designs and manufactures cutting-edge chips and is playing a critical role in enabling a globally competitive semiconductor ecosystem in the U.S.”

Under the leadership of Pat Gelsinger, Intel plays a crucial role in the U.S. strategy to achieve self-sufficiency in semiconductor production—a sector currently dominated by TSMC in Taiwan. Taiwan’s tense relationship with neighboring China adds a risk, as conflict in the region could disrupt global supply chains.

Intel’s crisis started with setbacks related to its Raptor Lake processors and worsened during the first half of this year. The company’s struggles have piqued the interest of potential buyers, including Qualcomm, Samsung, and Apple.